-

-

For Small Businesses: The Key to Less Painful IRS Audits

April 28, 2024

-

-

-

For Small Businesses: 2024 Q2 Tax Calendar

April 6, 2024

-

-

-

-

For Small Businesses: The Best Accounting Method Route for Tax Purposes

February 19, 2024

-

For Small Businesses: 9 Tax Considerations for New Sole Proprietors

February 7, 2024

-

-

For Small Businesses: On Qualified Small Business Corporation Status

February 1, 2024

-

-

For Small Businesses: On Tax Credit for Businesses with Tipping

January 11, 2024

-

-

For Small Businesses: On Company Cars & Taxes

December 18, 2023

-

-

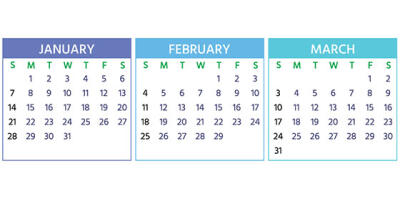

For Small Businesses: 2024 Q1 Tax Calendar Deadlines

December 18, 2023

-

-

For Small Businesses: New Pier Diem Business Travel Rates

December 5, 2023

-

For Small Businesses: The Social Security Wage Base Is Increasing

December 4, 2023

-

-

Infographic: A Tip for Retaining Employees

March 25, 2022

-

Infographic: Why Your Company Needs an Expense Reimbursement Policy

February 28, 2022

-

Infographic: What Investors Want to Know About Your Business

November 11, 2021